If you’re running a business, you already know how overwhelming finances can get. Bookkeeping virtual assistant services step in to handle every detail your records, reconciliations, reporting, invoices, payroll prep, and more. This allows you to focus on growth instead of paperwork.

What Exactly Does a Bookkeeping Virtual Assistant Do?

A bookkeeping VA manages your financial operations remotely with precision and consistency. They help you stay compliant, organized, and financially aware at all times. Your VA manages day-to-day bookkeeping tasks that are essential for clarity and decision-making, yet extremely time-consuming for business owners.

Their responsibilities typically include daily categorization of transactions, uploading receipts, preparing invoices, tracking payables, updating payroll data, and generating monthly financial reports.

Unlike traditional bookkeepers, a VA adapts to your business model, preferred tools, and workflow making them flexible, scalable, and cost-efficient.

Why Bookkeeping VAs Are Trending (2025 Industry Insights)

Based on fresh market data and growth trends, bookkeeping VA services continue to rise at a rapid pace. Businesses are no longer hiring full-time in-house bookkeepers because remote finance teams offer more flexibility and lower cost.

Here are the top growth indicators:

- Remote bookkeeping job searches increased 37% globally.

- Small businesses outsource 60% of financial work to virtual specialists.

- Automation tools (QuickBooks, Xero, Gusto, Dext) reduced manual work by 65%.

- Entrepreneurs now prefer subscription-based bookkeeping instead of salaried roles.

This shift is not temporary. It’s the future of financial management leaner, faster, and more flexible.

The Real Problem Most Businesses Face

Most founders don’t struggle because the tasks are hard. They struggle because they don’t have time. When your books fall behind even 30 days, your decisions become guesswork. Cash flow gets blurry. Tax season becomes a nightmare.

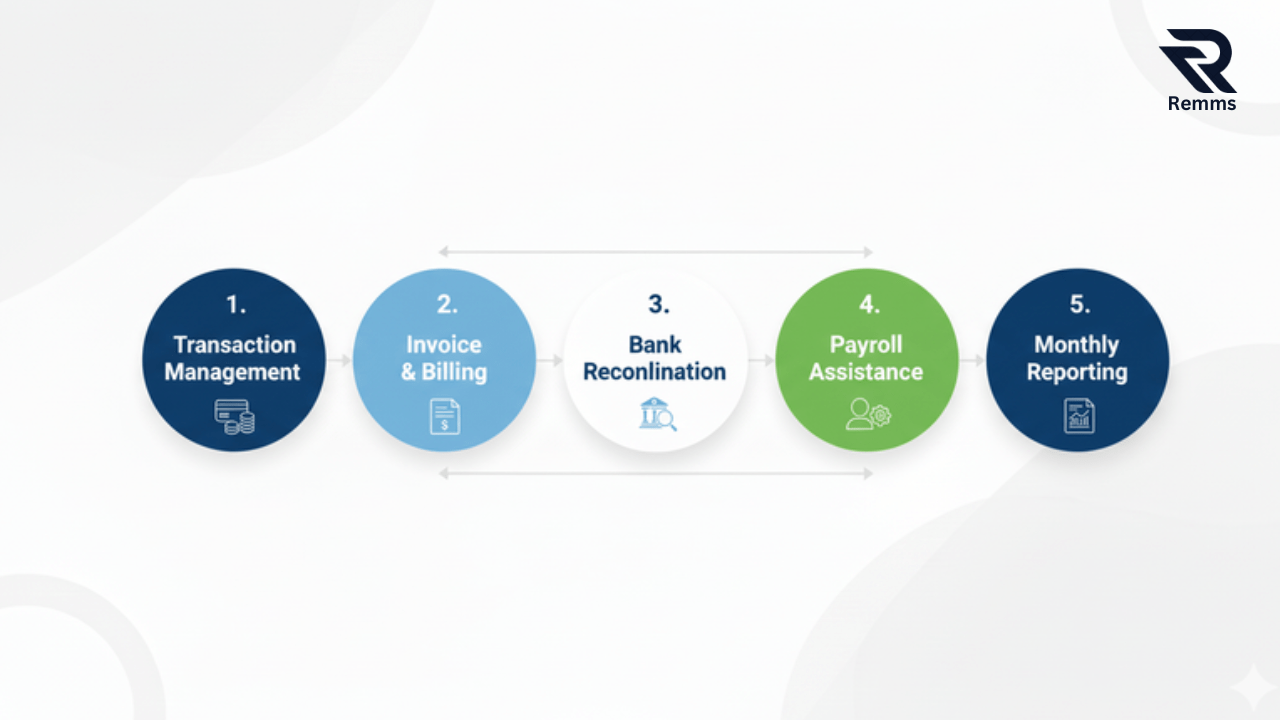

The 5-Layer Bookkeeping System

This proprietary framework outlines exactly what your bookkeeping VA should be doing to keep your financials clean, accurate, and scalable.

Transaction Management

Your VA reviews, imports, and categorizes all financial transactions daily. Whether it’s Stripe, PayPal, Amazon, Shopify, or POS data everything is organized in real-time.

Invoice & Billing Support

Missed invoices cost businesses thousands every year. Your VA ensures invoices go out on time, follow-ups are consistent, and cash flow remains predictable.

Bank Reconciliation

Every transaction must match. Every month. Reconciliation eliminates errors, fraud, and discrepancies. A VA keeps everything perfectly synced with your bank statements.

Payroll Assistance

Whether you pay weekly, biweekly, or monthly, your VA prepares payroll reports, maintains contractor details, and ensures everyone is paid accurately.

Monthly Reporting

Your VA creates clarity with monthly financial summaries: P&L statements, expense breakdowns, cash flow reports, and tax-ready files.

In-House Bookkeeper vs Virtual Assistant

| Feature | In‑House Bookkeeper | Bookkeeping VA |

|---|---|---|

| Cost | $3500/mo+ | $700–$1500/mo |

| Flexibility | Fixed hours | Adjustable workload |

| Scalability | Slow | Instant scale up/down |

| Tools | Limited | Expert in QuickBooks, Xero, Gusto |

Mini Case Study: Fixing a 9-Month Backlog

A growing SaaS startup approached us with a massive financial backlog 9 months of incomplete books. They had no idea what their real expenses, profits, or liabilities were.

Within 21 days, our bookkeeping VA cleaned, reconciled, and delivered a full set of financial reports. The founder discovered they were losing $4,700 every month due to duplicated tools and inefficient billing.

How a Bookkeeping VA Works With You Daily

- Access is securely provided to accounting tools.

- Your VA categorizes transactions and uploads receipts daily.

- Invoices are sent & follow-ups tracked.

- Accounts are reconciled weekly.

- Monthly reports are delivered for review.

- You make data-backed decisions confidently.

Key Takeaways

- A bookkeeping VA saves 20–30 hours every month.

- You get financial clarity instead of financial stress.

- Your business becomes tax-ready and audit-safe.

- You scale faster with real-time numbers.

Ready to Hire a Bookkeeping VA?

Let Remms manage your books so you can scale fearlessly.

Book a Free Consultation